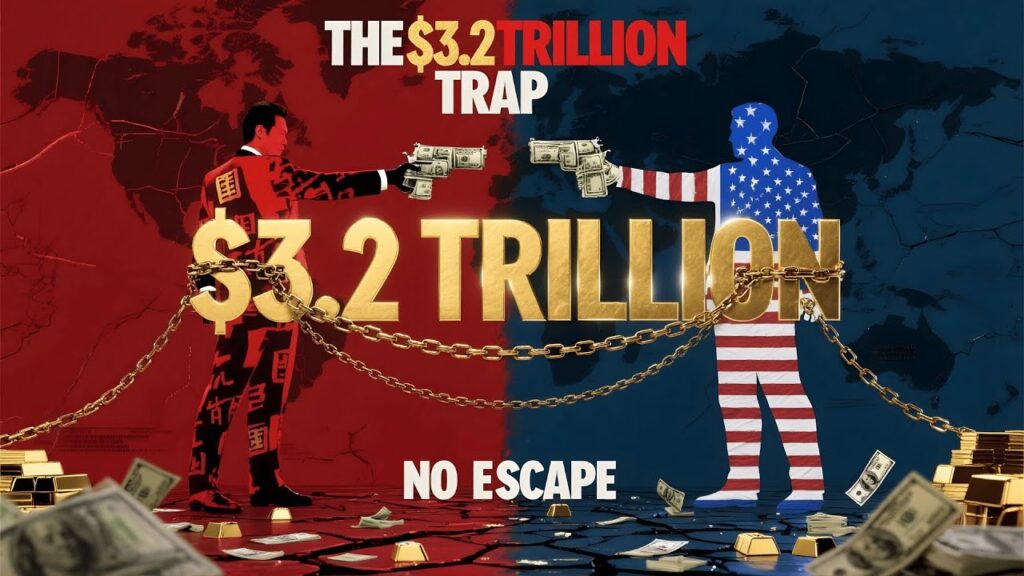

China holds $3.2 trillion in US dollar assets. Treasury bonds, corporate bonds, currency reserves, mortgage-backed securities, equities. More dollar exposure than any nation on Earth. For years, analysts warned: What if China dumps it all? The dollar would crash, interest rates would spike, US economy would collapse. It’s been called the nuclear option. The financial weapon of mass destruction. Except here’s the truth: China can’t use it. Not won’t. Can’t. Because the moment they pull that trigger, they destroy themselves faster than they destroy the US. The $3.2 trillion isn’t a weapon. It’s a trap. And both superpowers are locked inside with no way out.

THE HOLDINGS (As of July 2025):

US Treasuries: $731 billion (lowest since January 2009, down from $1.3T in 2013)

Corporate bonds: $300-500B

Currency reserves: $500-700B

Mortgage-backed securities: $200B

US equities (via sovereign wealth funds): $1-1.5T

Total: $3.2 trillion in dollar exposure

WHY CHINA CAN’T DUMP:

Scenario: China sells all $731B in Treasuries simultaneously.

Immediate effect: Bond prices collapse. 10-year Treasury yield spikes from 4.5% to 8-10%. Mortgage rates hit 13-14%. Housing market freezes. Corporate borrowing impossible. Credit markets seize. Banking crisis. Fed forced to print $731B to stabilize. Inflation explodes 20-30%. Dollar collapses 30% in FX markets.

But here’s what happens to China:

$750B instant loss: China’s remaining $2.5T in dollar assets loses 30% value = $750B gone (22% of China’s $3.34T total reserves). Central bank solvency crisis.

Export collapse: US consumers stop buying. Chinese factories shut. Unemployment spikes. Yuan surges 43% relative to dollar. Chinese goods become 43% more expensive for Americans overnight. $1,000 iPhone now $1,430. Demand evaporates.

Corporate debt crisis: $3T of China’s $28T corporate debt is dollar-denominated. 43% currency move = Chinese corporations owe extra $1.3T they can’t pay. Defaults cascade. Banking crisis.

Energy costs double: China imports all energy (oil, gas, coal) priced in dollars. Dollar collapse + yuan surge = pay more yuan for same energy. Manufacturing becomes uncompetitive.

Result: China’s export economy collapses, corporate sector implodes, banks fail, government forced to print yuan, inflation explodes, social unrest. China destroyed faster than US because economy more fragile, more export-dependent, yuan not global reserve currency.

THE TRAP MECHANISM:

China accumulated $3.2T over 40 years through trade surplus. Exported goods → received dollars → bought Treasuries to keep yuan weak → made exports cheaper → more sales → more dollars → more Treasuries. Self-reinforcing cycle. The $3.2T isn’t separate from China’s economic model—it IS the model. Those dollars are 40 years of accumulated national savings. Embedded in entire economic system. Can’t exit without destroying the system.

CHINA’S SLOW ESCAPE (2008-2025):

Gold accumulation: Official holdings 2,303 tonnes (Sept 2025), up from 600 tonnes (2008). Analysts estimate real holdings 5,000-7,000 tonnes ($740B at $4,000/oz). 2025: China discovered 3 massive gold deposits (3,400+ tonnes) in Liaoning, Kunlun Mountains, Hunan. Largest discoveries in modern Chinese history. Timing not coincidental.

Alternative payment systems: CIPS (launched 2015) processes $14T annually, growing 30%/year. Bilateral currency swaps with 35+ nations ($500B total). Yuan’s share of global trade: 2% (2015) to 7% (2025).

Treasury reduction: Cut from $1.3T (2013) to $731B (July 2025). July 2025 alone: cut $25.7B (steepest monthly drop in 2 years). Dropped from 2nd to 3rd place among foreign holders (behind Japan $1.15T, UK $899B).

Internal consumption shift: Consumption rose from 38% GDP (2010) to 55% (2025). Trade surplus down from $400B (2015) to $250B (2025).

THE TIMELINE PROBLEM:

China started escape 2008. 17 years later, only 25% complete. At current pace, full diversification takes another 20-30 years (2045-2055 before dollar exposure drops below $1T where dumping becomes feasible).

But US accumulating debt $2T/year. National debt $38.09T (Nov 2025). Interest costs approaching $1T annually (14% of federal spending). Dollar’s reserve status eroding: 72% (2000) → 58% (2024) → 56.3-57.7% (2025). At accelerating rate, hits critical 50% threshold by 2028.

The race: Can China diversify out of dollars before dollar collapses under own weight? Answer: No. China needs 20 years. Dollar’s structural problems suggest crisis within 5-10 years.

Credit to : Economy Rewind